Traveling, whether for leisure, work, or adventure, exposes you to a variety of experiences and challenges. While it is exciting to explore new places, it’s essential to understand the importance of health insurance while traveling abroad or domestically. Medical emergencies can happen anywhere, at any time, and the costs of health care abroad can be substantial. For this reason, travelers need to be informed about the role of health insurance when on the road, how it works, and how to ensure they are adequately covered.

This article will discuss why health insurance is essential for travelers, the different types of travel health insurance available, and how to choose the right coverage for your needs. We’ll also explore the challenges you may face when using your health insurance while abroad and tips to ensure peace of mind during your travels.

Why Health Insurance Matters for Travelers

When traveling, particularly internationally, your domestic health insurance may not cover medical expenses incurred abroad. For example, many U.S. health insurance policies, including Medicare, do not provide coverage for medical care outside the United States. Even if you are traveling within your own country, there may be gaps in your coverage for out-of-network care, or your plan might not cover certain emergencies like medical evacuation.

Health insurance for travelers serves as a safety net for unexpected medical issues, such as accidents, injuries, or illnesses. Having the right insurance can help cover:

- Medical expenses such as doctor visits, hospitalization, surgeries, and medications.

- Emergency services, including evacuation and repatriation, if necessary.

- Lost luggage or trip cancellations in some comprehensive policies.

- Travel delays that might require extra expenses, including additional accommodations or meals.

Without travel health insurance, you could face significant out-of-pocket costs for emergency medical care, which might be even higher in countries with private healthcare systems or where medical tourism is prevalent. A comprehensive travel health insurance policy ensures that you can seek medical attention without financial worry, and it offers a safety net should an emergency arise.

Types of Travel Health Insurance

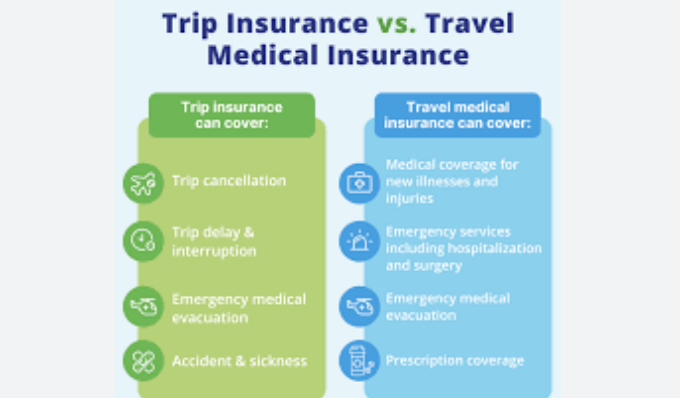

Not all health insurance plans are created equal, and there are several types of travel health insurance, each offering varying degrees of coverage. Here are some of the most common options available for travelers:

1. Emergency Medical Insurance

Emergency medical insurance is the most basic form of travel health coverage. It covers the cost of medical emergencies that occur during your trip, including hospital visits, medical tests, and surgeries. Emergency medical insurance typically covers:

- Emergency hospital care in the event of injury or illness.

- Doctor visits and treatments needed during the trip.

- Medications prescribed during the course of treatment.

- Ambulance and emergency transportation (including air ambulance in severe cases).

This type of insurance is especially important when traveling internationally, as medical expenses can quickly add up in countries where healthcare is privatized or expensive for foreign travelers.

2. Trip Cancellation or Interruption Insurance

Although not strictly health insurance, trip cancellation or interruption insurance may be bundled with health insurance policies to offer protection in case a medical emergency forces you to cancel or cut short your trip. If you fall ill or become injured before or during your travel, this coverage can reimburse non-refundable costs, such as flights, accommodation, or tours.

Additionally, it may cover unexpected expenses if your trip is interrupted, such as additional travel costs incurred from being forced to change your plans due to an emergency.

3. Medical Evacuation Insurance

Medical evacuation insurance is a crucial coverage option for travelers heading to remote or rural destinations where medical facilities may be limited. If you suffer a severe injury or illness that requires specialized treatment, medical evacuation insurance can cover the costs of transferring you to a hospital with the necessary facilities.

Medical evacuation typically involves airlifting a patient to the nearest qualified medical facility, which can be incredibly expensive without insurance. Evacuation insurance ensures that you can access appropriate medical care regardless of your location.

4. Travel Health Insurance for Seniors

Seniors may have unique health needs while traveling, and many travel insurance providers offer specialized policies for travelers aged 65 and older. These policies often include coverage for pre-existing medical conditions, which are typically excluded from standard travel insurance plans. Additionally, they may offer coverage for medical evacuation, emergency medical treatments, and repatriation in the event of death or injury.

Seniors should carefully read the terms and conditions to ensure that their specific medical needs are adequately covered. It’s also advisable to consult a healthcare provider before traveling to ensure they are fit to travel, particularly if they have existing health conditions.

5. Travel Health Insurance for Pre-Existing Conditions

Many travelers have pre-existing medical conditions, such as diabetes, asthma, or heart disease, that require ongoing treatment and care. Standard travel health insurance often excludes coverage for pre-existing conditions, but there are specialized policies that offer coverage for these medical issues. These policies may cover emergency treatments or hospitalizations related to pre-existing conditions, as well as routine medical care.

Travelers with pre-existing conditions should inquire about “pre-existing condition waivers,” which are provisions that waive the exclusions for specific conditions if certain requirements are met, such as purchasing the insurance within a certain time frame before traveling.

What’s Covered Under Travel Health Insurance?

Coverage levels vary depending on the type of insurance and the provider, but most travel health insurance policies will include some or all of the following:

- Medical expenses: Coverage for hospital bills, physician visits, surgeries, and emergency services.

- Emergency evacuation and repatriation: Emergency transportation to a medical facility, or back to your home country if necessary.

- Repatriation of remains: In the event of death, repatriation insurance ensures the return of the body to your home country for funeral arrangements.

- Lost baggage and personal items: Coverage for baggage loss, theft, or damage.

- Trip cancellation and interruption: Compensation for non-refundable expenses if you have to cancel or cut your trip short due to medical reasons.

- 24/7 emergency assistance: Many travel health policies offer access to a helpline that can assist with locating doctors, providing medical referrals, and arranging for transport if needed.

How to Choose the Right Travel Health Insurance

When selecting a travel health insurance policy, consider the following factors to ensure you have adequate coverage for your trip:

- Destination and Travel Duration: The country or countries you’re visiting can influence the type of coverage you need. Some countries have expensive healthcare systems, and you may want to invest in more comprehensive coverage, especially if you plan to travel for an extended period.

- Pre-Existing Conditions: If you have any pre-existing medical conditions, ensure that your policy covers them. Some insurance providers may exclude coverage for certain conditions, while others offer specialized plans that include this coverage.

- Level of Coverage: Determine the level of coverage that fits your needs. While basic emergency medical insurance may be sufficient for some, others may need additional coverage such as evacuation, cancellation, or lost baggage insurance.

- Deductibles and Limits: Check the deductible amounts and maximum payout limits for each type of coverage. For instance, some policies may have low deductibles but also come with caps on the total amount they will pay for medical services or evacuation costs.

- Provider Network: Verify whether the insurance provider has partnerships with hospitals or medical facilities in the area you’re traveling to. Some policies might limit your coverage if you need to seek care outside of their network.

- Cost: Travel health insurance premiums vary based on factors such as your age, health, destination, and trip duration. Compare plans to find one that fits your budget and needs.

Conclusion

Traveling is one of life’s greatest pleasures, but it can also introduce health risks, especially if you are in an unfamiliar environment or experiencing new activities. Health insurance for travelers is essential to safeguard against unexpected medical emergencies, high healthcare costs, and the challenges of being far from home in times of need.

Whether you are traveling for leisure or business, or even embarking on a long-term adventure, understanding your insurance options is key. Carefully evaluate the types of coverage you need, make sure you understand the terms of the policy, and choose a plan that provides peace of mind while you explore the world. Investing in travel health insurance ensures that your journey is filled with memorable experiences rather than stressful medical emergencies.