Floods are among the most common and costly natural disasters worldwide. They can strike unexpectedly, causing severe damage to homes, businesses, and personal belongings. Many homeowners assume their standard homeowners insurance covers flood damage, but this is a misconception.

Understanding flood insurance, how it differs from homeowners insurance, and how to protect your home from water-related losses is essential. This guide will cover:

✔ What flood insurance is

✔ How it differs from homeowners insurance

✔ Who needs flood insurance

✔ How much coverage you need

✔ Tips for lowering flood insurance premiums

What Is Flood Insurance?

Flood insurance is a separate insurance policy that provides financial protection against damage caused by flooding. It covers the structure of your home and, in many cases, your personal belongings, depending on your coverage.

Flood insurance is typically offered through the National Flood Insurance Program (NFIP), managed by FEMA, or private insurers.

🔹 What Counts as a “Flood”?

A flood is defined as:

- A temporary condition of water covering normally dry land

- Affecting two or more adjacent properties or covering at least two acres

- Caused by natural disasters, such as heavy rain, hurricanes, or rapid snowmelt

Example: If your basement floods due to a broken pipe, this is not considered a flood (homeowners insurance may cover it). However, if water rises from a nearby river and floods your home, flood insurance is required for coverage.

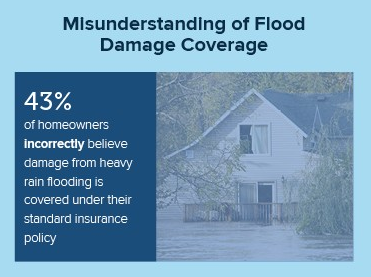

Does Homeowners Insurance Cover Flood Damage?

No, standard homeowners insurance does not cover flood damage. Most policies only cover water damage from internal sources, such as burst pipes or appliance leaks.

🔹 What Homeowners Insurance Covers:

✔ Water damage from a burst pipe

✔ Roof leaks caused by a storm

✔ Water damage from fire sprinklers

🔹 What Homeowners Insurance Does NOT Cover:

❌ Flooding from storms or hurricanes

❌ Overflowing rivers or lakes

❌ Heavy rain causing water to enter your home

To protect against flooding, you need a separate flood insurance policy.

Who Needs Flood Insurance?

Flood insurance is recommended for all homeowners, but it is mandatory for those living in high-risk flood zones (Special Flood Hazard Areas, or SFHAs) if they have a mortgage from a federally regulated lender.

🔹 High-Risk Areas (Mandatory Coverage Required):

✔ Coastal regions (hurricane-prone areas)

✔ Riverbanks and floodplains

✔ Low-lying areas with heavy rainfall

🔹 Moderate- to Low-Risk Areas (Optional but Recommended):

✔ Inland areas with occasional flooding

✔ Homes near small creeks or drainage systems

Example: Even if you don’t live in a high-risk flood zone, 25% of all flood claims come from moderate- or low-risk areas. Investing in flood insurance can still be a smart decision.

What Does Flood Insurance Cover?

Flood insurance policies typically offer two types of coverage:

1️⃣ Building Coverage (Structure of Your Home)

✔ Foundation, walls, and support beams

✔ Electrical and plumbing systems

✔ Built-in appliances (stoves, water heaters)

✔ HVAC systems (furnace, air conditioning)

✔ Detached garages (limited coverage)

2️⃣ Contents Coverage (Personal Belongings)

✔ Furniture and electronics

✔ Clothing, books, and valuables

✔ Portable appliances (washers, dryers, microwaves)

✔ Carpets and rugs (not wall-to-wall carpeting)

🔹 What Is NOT Covered by Flood Insurance?

❌ Landscaping, trees, and outdoor decks

❌ Damage caused by mold or mildew (if preventable)

❌ Temporary housing costs (hotel stays, rentals)

❌ Financial losses due to business closures (for home businesses)

Example: If a flood damages your flooring and electrical system, your building coverage would pay for repairs. However, if your TV and furniture are destroyed, you need contents coverage to receive compensation.

How Much Does Flood Insurance Cost?

Flood insurance costs vary based on:

✔ Your home’s location (high-risk or low-risk zone)

✔ The elevation of your home

✔ Your home’s structure and age

✔ The amount of coverage you choose

🔹 Average Cost of Flood Insurance

✔ NFIP policies cost $700–$1,200 per year (varies by location)

✔ Private insurers may offer cheaper or more comprehensive policies

Example: A home in Florida’s coastal region may have higher premiums, while a home in a low-risk inland area may pay much less.

How to Lower Flood Insurance Costs

While flood insurance is necessary, there are ways to reduce your premiums:

✔ Choose a higher deductible – Raising your deductible from $1,000 to $5,000 can lower your premium.

✔ Elevate your home – Homes built above base flood elevation qualify for lower rates.

✔ Install flood-resistant materials – Use water-resistant drywall, tile flooring, and sealed doors.

✔ Improve drainage around your home – Installing sump pumps and clearing gutters helps prevent water damage.

✔ Check private flood insurance options – Some private insurers offer cheaper rates than the NFIP.

Example: A homeowner in a flood zone who raises their home 3 feet above base flood elevation could save hundreds per year on premiums.

How to Buy Flood Insurance

Flood insurance is available through:

✔ National Flood Insurance Program (NFIP) – Government-backed, available through approved insurers

✔ Private flood insurance companies – Offer customized coverage and sometimes lower premiums

🔹 Steps to Buy Flood Insurance:

1️⃣ Check your flood zone using FEMA’s Flood Map Service

2️⃣ Compare NFIP and private insurance options

3️⃣ Get multiple quotes to find the best price

4️⃣ Purchase coverage before flood season (policies have a 30-day waiting period)

⚠️ Important: Most policies have a 30-day waiting period, so don’t wait until a storm is approaching to buy coverage!

Final Thoughts

Flooding is a major risk for homeowners, and standard home insurance won’t cover it. Whether you live in a high-risk flood zone or not, flood insurance is worth considering to protect your home from unexpected disasters.

✔ Flood insurance covers structural damage and personal belongings

✔ Homeowners insurance does NOT cover floods

✔ NFIP and private insurers offer coverage

✔ There are ways to lower premiums, like elevating your home