Purchasing a car is a major financial decision for many individuals, and for most people, taking out a car loan is necessary to make that purchase possible. However, before signing on the dotted line, it’s important to fully understand the terms and conditions of the car loan. These terms can significantly impact your finances, both in the short and long term. In this article, we’ll explore what you need to know about car loan terms and conditions, breaking down the critical components that can affect your loan repayment schedule, the total cost of the car, and your financial well-being.

What Is a Car Loan?

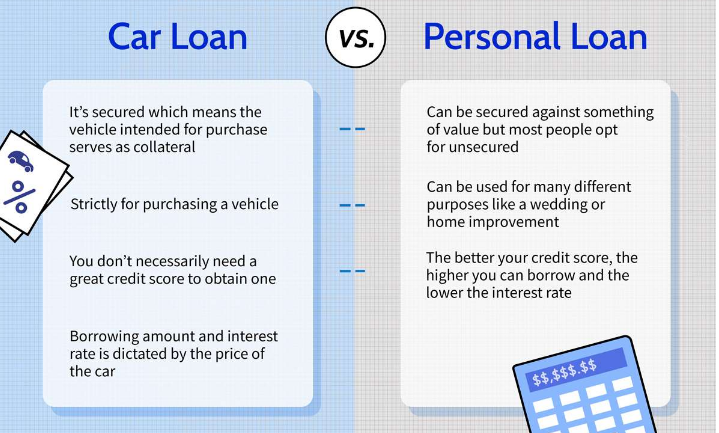

A car loan is a type of personal loan that individuals take out to purchase a vehicle. The loan typically involves a lender, such as a bank, credit union, or other financial institution, providing the borrower with a lump sum of money to pay for the vehicle. In exchange, the borrower agrees to repay the loan, with interest, over a set period of time.

Key Components of Car Loan Terms and Conditions

Car loan agreements can vary from lender to lender, but they generally contain several key elements that define how the loan will function. Let’s explore the critical components in detail:

1. Loan Amount

The loan amount is the sum of money you borrow from the lender to purchase the car. This is typically the vehicle’s purchase price, minus any down payment you make. A larger down payment can reduce the loan amount, leading to a lower total repayment amount and potentially better loan terms.

It’s important to note that some lenders may finance other costs as well, such as taxes, registration fees, and warranties. Be sure to understand what is included in your loan amount.

2. Interest Rate

The interest rate is the percentage of the loan amount that you pay in addition to the principal (the amount you borrowed). Interest rates can vary depending on several factors, including your credit score, the loan term, and the lender’s policies.

- Fixed Interest Rate: With a fixed interest rate, the rate remains the same throughout the loan period, making it easier to budget for monthly payments.

- Variable Interest Rate: A variable interest rate can change over time based on the market conditions, meaning your monthly payments may increase or decrease during the term of the loan.

3. Loan Term

The loan term is the amount of time you have to repay the loan. Car loans generally have terms ranging from 24 months to 84 months, although some lenders may offer even shorter or longer periods.

The term length directly affects the size of your monthly payments:

- Shorter Loan Terms (24–48 months): These loans tend to have higher monthly payments, but you pay off the loan more quickly and will pay less in total interest over time.

- Longer Loan Terms (60–84 months): Longer terms result in lower monthly payments, but you will pay more in interest over the life of the loan.

It’s important to balance an affordable monthly payment with the desire to pay off the loan as quickly as possible to minimize interest costs.

4. Monthly Payments

The monthly payment is the amount you’ll pay to the lender each month to repay the loan. The payment consists of both principal and interest, with the principal gradually decreasing over time as you make regular payments.

To calculate your monthly payment, the loan amount, interest rate, and loan term are used to determine how much you’ll need to pay. Many lenders offer online calculators that can help you estimate your monthly payment before committing to a loan.

It’s important to ensure that your monthly payment fits comfortably within your budget, as failing to make timely payments can lead to late fees, penalties, or even loan default.

5. Down Payment

A down payment is the amount of money you pay upfront when purchasing a car. This amount is subtracted from the loan amount, reducing the total amount you need to borrow. The size of the down payment can influence the loan terms, including the interest rate and monthly payment.

A larger down payment often results in better loan terms, such as a lower interest rate or shorter loan term. It also reduces the overall amount of interest paid over the life of the loan.

6. Fees and Charges

In addition to the interest, car loans often come with various fees and charges. Some of the most common include:

- Origination Fees: These are fees charged by the lender to process the loan. They are typically a small percentage of the loan amount.

- Prepayment Penalties: Some lenders charge a penalty if you pay off your loan early. This is to compensate the lender for the interest they lose out on by not receiving your monthly payments over the full term.

- Late Payment Fees: If you fail to make a payment on time, the lender may charge a fee. Repeated late payments can also result in higher interest rates or damage to your credit score.

- Title Fees: Some lenders may charge fees related to the transfer of the vehicle’s title during the loan process.

Always review the terms of your loan to identify any additional fees, and factor these costs into your overall financial planning.

7. Secured vs. Unsecured Car Loans

Most car loans are secured loans, meaning the vehicle itself serves as collateral. If you fail to make your payments, the lender can repossess the car. This adds a level of risk for borrowers, but it often results in lower interest rates due to the collateral involved.

An unsecured car loan, on the other hand, does not involve collateral. While these loans are less risky for the borrower, they are typically more difficult to obtain and come with higher interest rates because the lender has no asset to claim in case of default.

8. Loan Approval Criteria

Before you apply for a car loan, it’s essential to understand the lender’s approval criteria. Lenders typically assess several factors before approving a loan:

- Credit Score: Your credit score plays a significant role in determining whether you qualify for a loan and what interest rate you’ll receive. A higher credit score generally results in better loan terms.

- Income: Lenders want to ensure that you can afford the monthly payments, so they may review your income and employment status.

- Debt-to-Income Ratio: This ratio compares your debt payments to your income. A lower ratio indicates that you’re less risky to lend to.

- Vehicle Information: Lenders may also review the car’s make, model, and age to assess its value and whether it serves as adequate collateral.

9. Loan Default and Repossession

If you fail to make timely payments on your car loan, the lender may initiate a loan default process. Loan default typically occurs after a series of missed payments, and the lender may repossess the car as collateral.

Repossessing a vehicle is a serious consequence, and it can severely impact your credit score. To avoid this situation, it’s crucial to ensure that you can meet the monthly payment obligations before taking on a loan.

10. Refinancing

If you find that your current car loan terms are no longer favorable, or if your financial situation has improved, you may consider refinancing your loan. Refinancing involves replacing your current loan with a new loan, often at a lower interest rate or with better terms. This can help reduce your monthly payments or shorten your loan term, ultimately saving you money.

Conclusion

Understanding the terms and conditions of a car loan is essential to making an informed and responsible decision when purchasing a vehicle. By carefully considering the loan amount, interest rate, loan term, monthly payments, and any associated fees, you can ensure that you choose the loan that best fits your financial situation. Always remember to shop around for the best rates and terms, and take the time to read the fine print before signing any agreement.

Making informed decisions regarding car loans will help you navigate your car purchase with confidence, enabling you to manage your finances effectively while enjoying your new vehicle.