Estate planning is an essential part of managing your assets and ensuring that your loved ones are taken care of when you’re no longer around. It involves a variety of legal and financial strategies to ensure that your estate is distributed according to your wishes. Many people associate estate planning with creating wills, establishing trusts, and minimizing taxes. However, one of the often-overlooked aspects of estate planning is home insurance. Home insurance plays a significant role in protecting your property and providing financial stability to your heirs in the event of an unforeseen incident, such as damage to your home or the loss of property.

This article will explore how home insurance fits into the broader picture of estate planning, why it’s important, and how to ensure that your home insurance policy aligns with your estate planning goals.

The Basics of Home Insurance

Before delving into how home insurance impacts estate planning, it’s important to understand the basics of home insurance itself. Home insurance, also known as homeowners insurance, provides coverage for your home and belongings in the event of damage or loss due to incidents such as fire, theft, vandalism, or natural disasters (depending on the policy). It typically includes the following:

- Dwelling Coverage: This protects the structure of your home from damage due to events like fires or storms.

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and valuables, in the event of damage or theft.

- Liability Coverage: This protects you financially if someone is injured on your property or if you cause property damage to others.

- Additional Living Expenses (ALE): This covers the cost of living elsewhere if your home becomes uninhabitable due to damage.

Home insurance is typically purchased as a yearly policy, and the coverage can be adjusted depending on the needs of the homeowner.

Home Insurance and Estate Planning

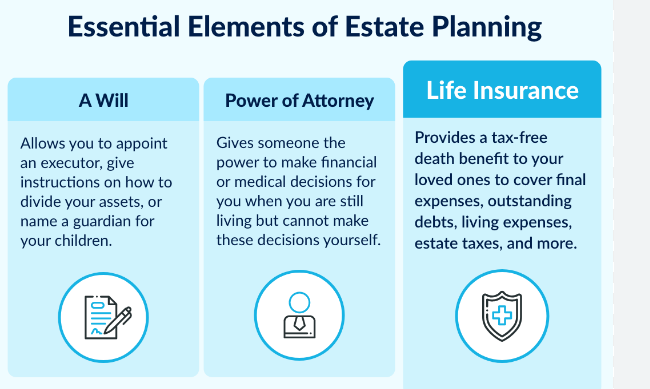

Estate planning is about ensuring that your estate is handled according to your wishes after your death. It usually involves several components, including wills, trusts, powers of attorney, and beneficiary designations. However, many homeowners overlook how their home insurance policy fits into this plan, especially when it comes to the inheritance of their property.

When you incorporate home insurance into your estate planning, you’re taking steps to protect the value of your home and assets, ensuring your loved ones can smoothly transition into their new responsibilities after your passing. Here’s a closer look at how home insurance plays a role in estate planning.

1. Protecting Your Home’s Value for Heirs

Your home may represent one of the largest and most valuable assets in your estate. Whether you plan to pass it on to your children or another beneficiary, it’s crucial to have adequate home insurance coverage to protect that value. If an unforeseen event occurs and your home is damaged or destroyed before your estate plan is executed, the value of your home could be significantly diminished. This can affect the value of your estate, which might not align with your intentions for how assets should be distributed.

For example, if a fire destroys your home and the dwelling is not fully covered by your insurance policy, the proceeds may not be enough to rebuild the property, leaving your heirs with an incomplete inheritance. Without the right insurance coverage, your home may not retain the value you had planned to pass down, complicating the estate settlement process.

By ensuring that your home insurance policy offers sufficient coverage, you guarantee that the home’s value will be preserved for your heirs. It’s important to regularly review your policy to ensure that it keeps up with changes in the real estate market, inflation, and improvements you make to the home.

2. Preventing Financial Burden on Heirs

Without the proper home insurance, your heirs could inherit a home that comes with financial burdens. For instance, if the home is damaged and the insurance coverage is inadequate, your beneficiaries might be responsible for paying for repairs or rebuilding the property out-of-pocket. If they can’t afford to make these repairs, the property might lose value or even become uninhabitable, which defeats the purpose of leaving the home to them in the first place.

Additionally, heirs may inherit the responsibility for paying any remaining mortgage or debts tied to the home. If the home isn’t properly insured, the costs involved in repairing or replacing it could place a significant financial strain on your family.

To mitigate these risks, ensure your home insurance policy includes sufficient coverage to rebuild the home at current market rates and adjust the policy regularly to reflect the changing value of the property. You may also consider adding “Guaranteed Replacement Cost” coverage, which covers the full cost of rebuilding without factoring in depreciation.

3. Home Insurance as Part of Your Estate’s Liquidity

One of the critical elements of estate planning is ensuring that your estate has enough liquidity to cover expenses, including taxes, debts, and administrative costs. If you have a home with significant value, but it is uninsured or underinsured, your estate may face challenges in fulfilling these obligations. In a worst-case scenario, your family could be forced to sell the property quickly to meet these expenses.

Adequate home insurance can provide the necessary liquidity to cover rebuilding costs if the home is damaged or destroyed. It can also provide coverage for temporary living expenses if your heirs need to move out of the home during repairs. This can help ensure that the estate remains financially solvent and your beneficiaries are not forced to sell the home under duress.

4. Including Insurance Provisions in Your Will or Trust

When drafting your will or trust, it’s important to consider how your home insurance policy fits into the overall management of your estate. While home insurance doesn’t directly pass to your heirs, it can be included in your estate planning documents to make sure the home is adequately protected after your death.

For example:

- Trusts: If you have set up a living trust to manage your assets, including the home and other property, make sure that the trust specifies who is responsible for maintaining the home insurance policy. This ensures that the trust can continue to provide financial protection and smooth transitions for your heirs.

- Will Provisions: You can also include provisions in your will that require your estate executor to maintain home insurance coverage on your property, ensuring that it remains properly insured during the estate administration process.

By incorporating your home insurance into your estate planning documents, you ensure that the property is protected, and your wishes for the home’s future are honored.

5. Planning for Home Insurance Changes After Your Death

After your passing, there may be changes in how the home is used or managed. For instance, if your heirs decide to sell the home or rent it out, the insurance coverage requirements will change. It’s important to plan for these future needs by discussing home insurance changes with your heirs. This can include providing them with the contact information of your insurance provider or having a conversation about what adjustments may need to be made.

If you plan to leave your home to a charity or non-profit, it’s essential to consider how the property will be insured after you’re gone. Some charitable organizations may have specific requirements for insurance coverage, and you should ensure that your estate plan addresses this.

6. Considering Additional Coverage Options

In addition to standard homeowners insurance, there may be other types of coverage that could be beneficial when incorporating home insurance into your estate plan. These may include:

- Flood Insurance: If you live in a flood-prone area, consider purchasing flood insurance to protect your home. This type of insurance is often not covered by standard home insurance policies but can be crucial for estate planning in certain areas.

- Umbrella Insurance: This provides additional liability coverage that can protect your assets from lawsuits and claims that exceed the limits of your home insurance policy. An umbrella policy can safeguard your estate from financial ruin in the event of an accident or lawsuit.

- Home-Based Business Coverage: If you run a business from home, you may need additional coverage for business-related risks. This can be particularly important if the home business is part of your estate.

Conclusion

Home insurance is an important part of estate planning, helping to ensure that your home remains a valuable asset to pass down to your heirs. By carefully choosing the right coverage and regularly updating your policy, you can prevent financial burdens on your family and ensure a smooth transition of your property. Incorporating home insurance into your estate plan is a proactive step to safeguard your home and maintain its value for future generations. Make sure to discuss your home insurance needs with your financial advisor or estate planner to ensure that it aligns with your overall estate strategy.